We commonly get the question: why are mortgage rates so low? The 30-Year fixed rate mortgage has not been lower in almost 50 years of recordkeeping. Conventional wisdom regarding the direction of interest rates has continued to be wrong over the last decade. Many thought interest rates would move back up after the Great Recession. There has been no shortage of ink spilled or airtime spent talking about trying to guess the direction of rates. The list of people is short who thought rates would be this low in 2020.

Why So Low?

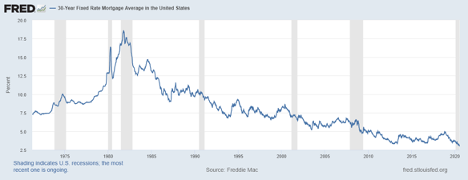

As you can see in the chart below, the 30-year fixed mortgage interest rate is closely correlated with the direction of the federal funds rate. The federal funds rate is controlled by the Federal Reserve.

When the Federal Reserve wants to encourage more economic activity, they lower interest rates. You can see the red line drop through each recession (marked by shaded area). Seemingly the rates hit new lower lows with each subsequent recession. Because interest rates are used in valuing many types of assets, lower interest rates also have an effect of stabilizing or even increasing asset prices (i.e. real estate and stocks prices).

The obvious example is residential housing prices. As interest rates have fallen, more families have been able to afford higher housing prices. This is due to the monthly payment calculation. Purchase prices have increased but due to the lower interest rates, the monthly payment can stay the same. Thus, lower interest rates have not necessarily decreased new homeowner monthly payments. The lower monthly payments are more likely felt over time by existing homeowners who can refinance to lower rates. Or another way of saying maybe you have to be an existing asset owner to benefit from lower rates.

Takeaway

As interest rates have continued to fall over the last 50 years, asset prices have continued to rise. Investors have generally benefited from both of those occurring by simply staying invested over the long-term. Seems counterintuitive, but those less active made more than some actively guessing every year. Some might say the smart money was made by not succumbing to the urge to play the guessing game!

I do not believe this natural urge ever leaves investors. It might just be weaker or stronger throughout time. The urge today is strong as ever with “lowest ever” rate headlines emerging. The helpful reminder is looking back at the chart, that headline could have consistently been used for the last 30 years.

The lesson is do not guess and just keep refinancing that mortgage!