“Life is like riding a bicycle. To keep your balance, you must keep moving.” – Albert Einstein

January in the Midwest can be a difficult place to spend your days. Cold and dark days are frequent weather forecasts. The hearty Midwesterners usually have their way of dealing with this somber forecast (travel, spending time doing outdoor winter activities, indoor events, etc.). No matter the method the goal is to think of better days ahead. Spring will eventually arrive. Just need patience and temperament. Keep moving.

The same forecast could be said for the investment world. Financial conditions are signaling global recession potentially ahead. Usually, there is never a lack of worries in the world. Here are just a few things causing concern today:

- How high will the Federal Reserve raise interest rates to curb inflation,

- Will higher rates cause bigger issues with company earnings, consumer spending, and ultimately unemployment rates,

- How will the ongoing war in Ukraine play out, and

- How will China’s change in COVID policy affect global economic activity?

The good news is forecasts are always cloudy. We are also a believer in the statement “it is not the things that you do not know that will hurt you, it’s the things you think you know that turn out to be not so.” Although this list above is the standard list most forecasts start with, it probably does not contain the big event that could turn markets sharply. It is important to keep that in mind.

The big story in the US continues to be the Federal Reserve’s direction on interest rates. The Fed is tasked with stopping inflation from becoming entrenched in the decision-making of households and businesses. The trouble with that task is that the only way to know that inflation has not become entrenched is to see economic activity decrease. They do not have the luxury of saying “We have done enough. We just need to hold still and watch inflation come down.”

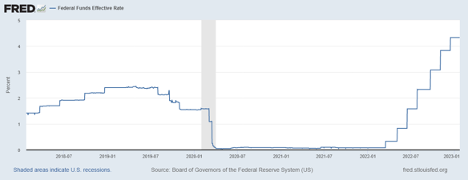

Some say this is what caused inflation to the spike in 2021 and 2022. The Federal Reserve thought inflation was transitory. They believed they just needed to wait. With time, inflation would start to come down. However, this was not happening. They eventually decided action was needed. That action began in March 2022 with the increase of the federal funds rate.

Short-Term Rates

The effective federal funds rate began in the 2023 calendar year at 4.25%. As the previous chart shows, this rate was close to 0% at the beginning of 2022. This is an important rate that has ramifications for all asset returns. It is the base level of all return expectations. So where does it go in 2023?

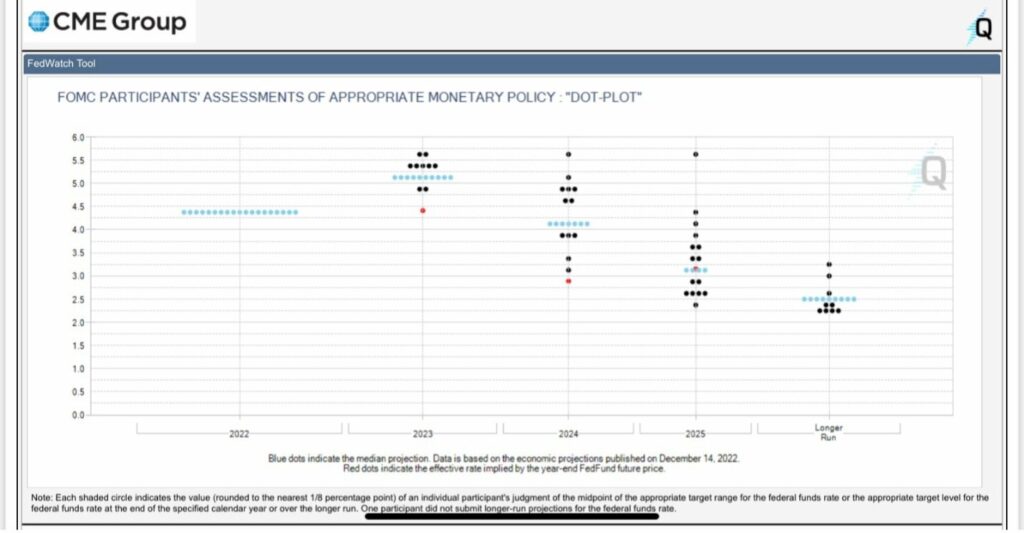

If you were able to predict this with great accuracy, investing would be easy. However, it is difficult to estimate with high confidence where it might be in twelve months. The following chart shows what the market is pricing in versus what the Federal Reserve expects. The light blue dots are the Federal Reserve median projections. The red dot is the current market expectation. You can see there is some discrepancy. 1

We think short-term interest rates are probably going to stay higher for a while longer. We arrived at this based on a few things. First, the Federal Reserve has three mandates: low inflation, low unemployment, and ensuring financial structure functions. Currently, unemployment is low and the financial structure is stable. Thus, inflation is the mandate that continues to get all the attention. Until something material changes in unemployment or financial structure stability, the Fed seems destined to drive inflation lower. To do that, they will probably need to keep rates higher for longer.

Where the Fed ultimately stop is a guess at best. However, it would seem logical given their focus on inflation that they will not stop raising interest rates until inflation is below the federal funds rate. Given current trends potentially late spring/early summer might be the first time that has a possibility of occurring. Here is what you can find on the homepage of the Federal Reserve Bank of St. Louis (the St. Louis location has primary responsibility for data research). 2

From above, you can see that inflation at 5.54% is still above the federal funds rate of 4.33%. We expect interest rates to rise until that inflation number is lower. How high inflation continues to run will affect how much higher interest rates will need to go.

Parting Words

Investment returns are important. They help sustain financial independence for us and other important people in our lives. However, overreacting year by year to what the investment returns are can lead to an unhealthy lifestyle. The “good life” we aspire to usually comes for many through patience and temperament.

Even though there might be volatility ahead, to keep our balance we just might need to keep moving.

Thank you for your continuing trust and please do not hesitate to contact us with any questions.

1 https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html?itm_source=rates_recap_article&itm_medium=hypertext&itm_campaign=rates_recap&itm_content=012023

2 https://www.stlouisfed.org/