We have spoken about inflation the last few months. As expected, the topic continues to drive many conversations. Much like other investment decisions, the inflation data is only the start of the process. Just as consequential is the reaction to the data.

Federal Reserve Goal

Conducting monetary policy is one of the five key functions of the Federal Reserve System. Monetary policy is defined as “ promoting maximum employment and stable prices in the U.S. economy”.1 Both maximum employment and stable prices have an element of subjectivity. What is the correct employment number? What is the desired stable price? What is the best way to measure employment and prices? The answer comes down to a best guess. This is important to know. Humans are behind these decisions, not machines.

Stable prices certainly do not mean the same prices. Rather the Fed has tried to define “stable” as 2% increases. Anything above or below 2% is not ideal. For much of the last decade, inflation has been below 2%. This past 12-month inflation increase was 6.8%.2 Cleary, not ideal.

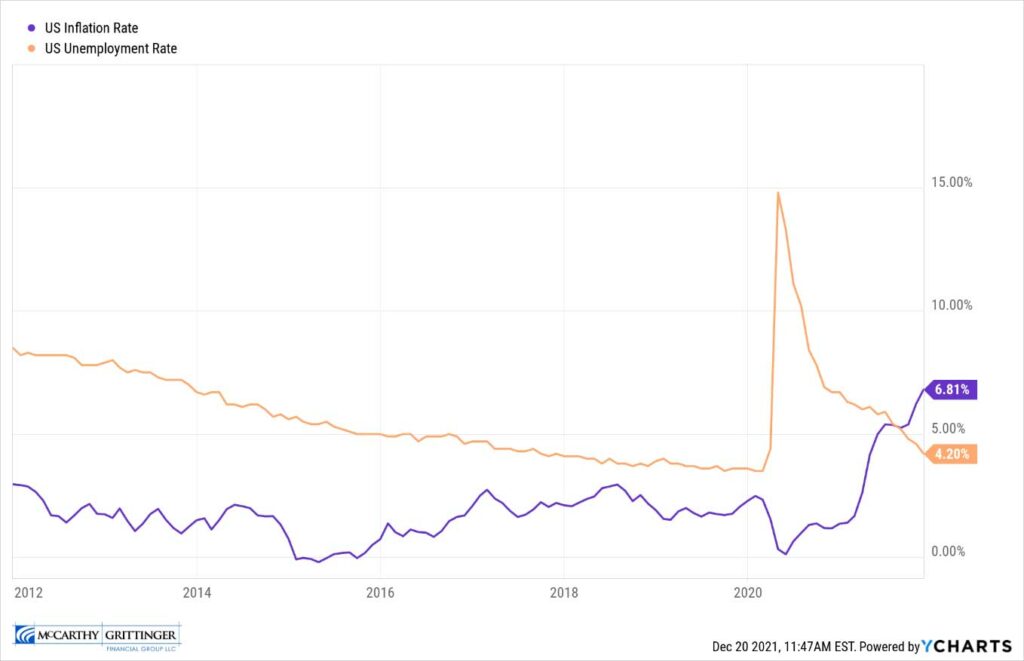

With the pandemic upheaval, the inflation and employment rates have been on roller coaster rides. Unemployment numbers spiked at the start of the pandemic and now are on their way back down. Inflation rates went down at first and now are on their way up. The pandemic has caused some unnatural numbers to appear, so it’s important to remember the pandemic timeline. It was only one year ago that the vaccines started to become available. It is not unreasonable to think the price increases began to change at the same time as more people began to return to normal life.

Fig.1 Graph of US Inflation Rate vs US Unemployment Rate

Monetary policy is at crossroads again. The two goals of maximum employment and stable prices are heading in different directions. In response, the Fed has stated they will begin shifting their strategy to provide less liquidity. Assuming prices continue their march higher, we should expect rate increase in 2022.

Current Rate Environment

As the inflation figures continue to rise and the Fed projects rate increases in 2022, what has shocked some is the resistance of long-term interest rate to rise in tandem. As of December 17th, the US Treasury 10-year rate sits at 1.4%. This rate was 0.91% at the start of the year. Essentially only a 0.5% increase since the beginning of the year. The US Treasury 30-year rate started the year at 1.6%. As of December 17th, it is 1.8%. Certainly not what people would expect if you told them the currently released 12-month inflation rate.

Fig.2 Graph of 10 Year Treasury Rate vs 30 Year Treasury Rate

However, this is another reminder that the bond and stock markets are much more complicated than a few numbers. If inflation goes up, interest rates should go up, but not always. It is not that simple. Could rates rise from here? Certainly. Is it a foregone conclusion? No.

Investment Decisions

Uncertainty about the future continues to prevail while decisions about investments continually need to be made. Should investors make drastic changes to try and guess about that uncertainty? In these moments of bigger price moves, it is important to remember “your” reason for investing. Is it to catch all the short-term moves in the market? Then millisecond trades matter. Is it to provide for spending measured in decades? Then maybe daily movements are less important.

The pandemic continues to put fuel on the uncertainty fire. We cannot be certain how the virus will mutate, spread, and effect individuals. We cannot be certain how countries will react to whatever the virus ends up doing. When individuals arrive at a simple forecast, imagine how many shortcuts they had to take to arrive at that forecast. Ironically, when the forecast is wrong, the reason will be “well I didn’t know that was going to happen” or “if that person didn’t do that, I would have been correct”. Who doesn’t love those “it wasn’t my fault” arguments?3

In investing, knowing limitations is important. If the portfolio is going to be spent over decades, then avoiding the big mistakes matters. “Not my fault” arguments are not going to help if damage has already been done. Similar to what I tell my 15-year old twins learning to drive. The goal of driving is no accidents. Driving is not a game of “not my fault.” You must be ready to adjust to other driver mistakes too. I tell them if I visit them in the hospital after an accident, discussing whose fault it was will not make their body heal faster. Assess probability and severities when driving to avoid the big mistake.4 Investing is no different.

Diversification helps mitigate the big mistakes. It should provide confidence to continue to move forward no matter how dark the clouds seem to be right in front of us. Long term there are still many reasons to be optimistic. Diversification helps ensure the portfolio is around to benefit.

Investment Decisions

There have been recent news reports about the popularity of I bonds. We thought an explanation of how this works would be helpful. Essentially, these are savings bonds:

- Can be purchased online from the US Treasury Department (up to $10,000/person per year),

- Bonds purchased within a month are issued as if all purchased on first day of month

- Interest rate is sum of fixed rate (currently 0%) and inflation rate (currently 7.12%)

- Interest compounds semiannually at rate established at purchase

- Interest is added to the bond value (not paid to purchaser semiannually), and

- Interest rate resets every six months from date of original issuance.

- Must be held at least 1 year. After 1 year, can be redeemed but will pay 3-month interest penalty

- If held longer than 5 years, there is no penalty.

We think it is easier to understand with a current example:

- I create online account at Treasurydirect.gov tomorrow. I link my bank account where I have$10,000 cash. I do not need this cash for another year (preferably at least 5).

- I purchase $10,000 Series I Bonds electronically on December 19, 2021. Issuance date of December 1, 2021.

- The current annual rate is 7.12% (0% fixed plus 7.12% inflation).

- From December 1, 2021 through June 1, 2022, my bond will earn $356 interest.

- On June 1, my bond value will be $10,356.

- The interest rate on June 1 will reset to rate that will be announced in April 2022.

- On December 1, 2022 I could redeem my bond, but would lose last 3 months of interest.

- On December 1, 2026, I could redeem my bond with no 3-month interest penalty.

There is no doubt that the current annualized interest rate of 7.12% is above any similar risk adjusted investment. However, before rushing to purchase there are a few things to consider.

- Married couples could purchase up to $10,000/each in December and then $10,000/each in January 2022 (for total of $40,000).

- Requires comfort with online registration and willingness to link bank accounts on your own. This is online only process.

- Requires proper registration and beneficiary designation to not disrupt current estate plan

- Requires excess cash at bank currently that you do not need for at least a year.

Given the current interest rate environment, we anticipate you seeing this more in the popular press. Although we cannot purchase these bonds through our management, please let us know if you have any questions about these bonds.

MG Team Updates

Congratulations to Jacob for acquiring two separate designations this past month! First, he became our latest CFP® in the office. We now have six CFP® professionals in our office. The CFP® certification has education, examination, experience, and ethics requirements.5 He has been hard at work these past few years working towards this achievement.

In addition, Jacob recently passed his final Enrolled Agent test. This will allow him to represent taxpayers before the Internal Revenue Service.6 As we approach the end of another tax year, he will be able to put this recent credential to good use. Congratulations, Jacob, on these recent accomplishments!

Continuing education and professional credentials are important part of our firm’s culture as we seek to continually improve our services for current and future clients. Jacob’s recent success is reminder of the excitement we have for future opportunities for our clients and team members.

Happy Holidays

We hope everyone gets an opportunity to spend some time with family and friends over the next few weeks. There is certainly much to worry about in this world, but also hopefully much to be thankful for. Finding those glimpses of hope is what can make life worth living and long-term investing worth doing.

All the best this holiday season from your McCarthy Grittinger Team.

- https://www.federalreserve.gov/aboutthefed/the-fed-explained.htm

- https://fred.stlouisfed.org/graph/?g=8dGq

- Right of passage arguments for parents and kids alike

- I am sure they would prefer to learn to drive with their mom

- https://www.cfp.net/get-certified/certification-process

- https://www.irs.gov/tax-professionals/enrolled-agents/enrolled-agent-information