“Uncertainty is the only certainty there is, and knowing how to live with insecurity is the only security.” – John Allen Paulos

Uncertainty Everywhere

As we have written in the past1, the future is uncertain. Armed with this knowledge, hopefully, we can make the big and small daily decisions to move forward. We do this regardless of the endeavor. Whether it is facing decisions to retire, to move residences, or to simply select a college, each decision has risks. All those decisions have an element of uncertainty. All require a leap of faith to move forward.

Although history can help with future uncertainty, it is not perfect. History is a study of past events that happened. It is not the study of past events that could have happened. Thus, it is difficult to separate the actual from the possible in hindsight. It becomes exponentially harder if someone has never stopped to think history had potentially different a path. One little change here or there and history could look very different.

- Had we not retired then…

- Had we not moved there….

- Had we selected that school to study at…

Uncertainty is an inherent aspect of investing too. Usually, investors can easily see the path the investment traveled. In contrast, an investment’s future path can be far-ranging. Future investment outcomes are filled with an array of unknowns. Understanding and managing this uncertainty is crucial for investors.

Debt Limit

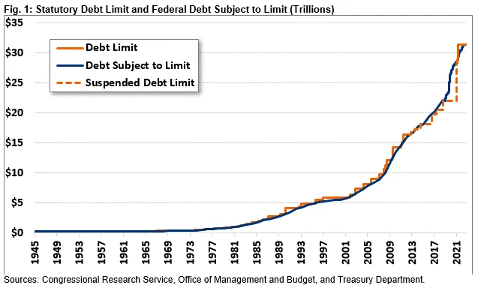

Although we could write for days about all the uncertainties in the world today, we will focus on one here. The debt ceiling and its possible ramifications for the months ahead. As elected officials move to a resolution (for now), it is helpful to know a little about the debt limit history. The graph in Figure 1 is a good illustration of this history.2 You can quickly see that we have been here before. Although the exact path is uncertain, you can start to see the trail ahead using the past as your guide.

US Treasury General Account

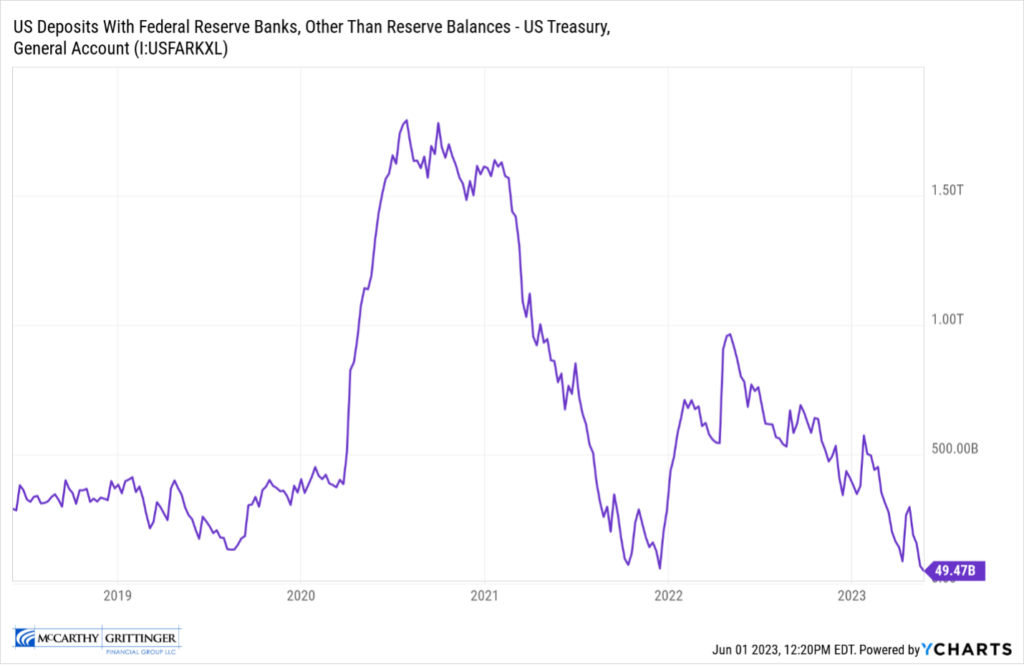

The US Treasury General Account refers to the line item on the Federal Reserve’s balance sheet that tracks the country’s short-term liquidity. Essentially, this is the country’s checking account. In normal years, this account fluctuates as tax receipts are received, expenses are paid, or new debt is issued. Like commercial banks, the US Treasury has its own account at the Federal Reserve.3 (As you pay your incomes taxes, the money moves from your bank account to the Federal Reserve’s US Treasury account.)

From the chart below you can see the Treasury General Account balance over the last few years and how low it is currently running. Regardless of political views, something must happen. This is not sustainable.

US Debt Issuance

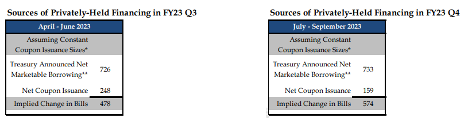

How does the country refill their checking account? Either bring in more tax revenue while reducing expenses or get a loan. It would appear the current answer is get a loan (i.e. issue more debt). Once the debt limit has been raised, the Treasury will begin in earnest to issue debt to the public and refill the checking account. The Treasury’s latest projection of issuance for the final two quarters of the 2023 fiscal year is $1.459 trillion.4

The next obvious question is who is going to buy this debt and where is that money going to come from.

- How much from existing bank deposits? Will that put additional pressure on banks?

- How much from money market funds, bonds, or stocks? How will that affect market prices?

The answers to those questions could certainly influence portfolio performance in the short-term. For those investors trying to time the markets in the short term, this would be a factor along with interest rates, unemployment projections, inflation expectations, and general economic activity.

Long Term Investors

Although the debt ceiling has ramifications for the immediate months ahead, the exact outcome is very much unknown. In addition, debt ceiling decisions will affect interest rate decisions. Interest rate decisions will affect economic activity. No decision can be viewed in isolation. Getting these all correct in the short-term is hard.

Long-term investors have an advantage. They do not need to get every short-term movement right. However, to do that requires adopting a disciplined and strategic approach with diversification usually leading the charge. The goal is to reduce the impact of specific events or risks on the overall portfolio (debt ceiling, interest rate risk, economic downturns, etc.). In the short-term diversification is not a bulletproof solution, but it can reduce the likelihood of permanent loss. Fortunately, avoiding permanent loss is usually high on the list of goals for long-term investors.

Moving Forward

Being knowledgeable about the ongoing debt limit can be important. However, maybe not for the reasons many may think. While staying informed can help become a better voting citizen, this knowledge does not necessarily translate to more successful investment performance. There are just too many uncertain variables at play that the outcomes in the short-term can be drastically different than initial expectations. Long-term investors advantage is time. Probably best not to waste it.

For those in the Midwest, two weeks of spring are over so on to summer!

Thank you for your continuing trust in your McCarthy Grittinger team.

1 https://mgfin.com/the-illusion-of-certainty/

2 R43389 (congress.gov)

3 Federal Reserve Balance Sheet: Factors Affecting Reserve Balances – H.4.1 – May 25, 2023

4 TreasuryPresentationToTBACQ22023.pdf