“Think of the markets’ force as a raging river. Any experienced rafting guide will tell you not to fight the rapids. You’re better off charting your course, adapting incrementally and not oversteering.”

-David Booth

Recession Investing for Long-Term Investors

Investing for the long-term requires ignoring short-term noise. Part of that noise is the inundation of frequent recession predictions and subsequent calls to bail on investing. For long-term investors, recessions are part of the deal. There is no way to avoid them. For better or for worse, long-term investors are company owners during good and bad times.

This does not mean things do not change. They certainly do. However, the day-to-day changes are mainly being made at the company level. Management teams, who are hired and fired by stock owners, are responsible for ensuring proper changes are implemented. Remembering investors are just an extension of the underlying business can be helpful during market price volatility.

For interactive chart of market returns through a century of recessions click here

View a chart of market returns through a century of recessions.

Fig.1 Graph of long-term investment showing increasing return over time

Market Price Volatility

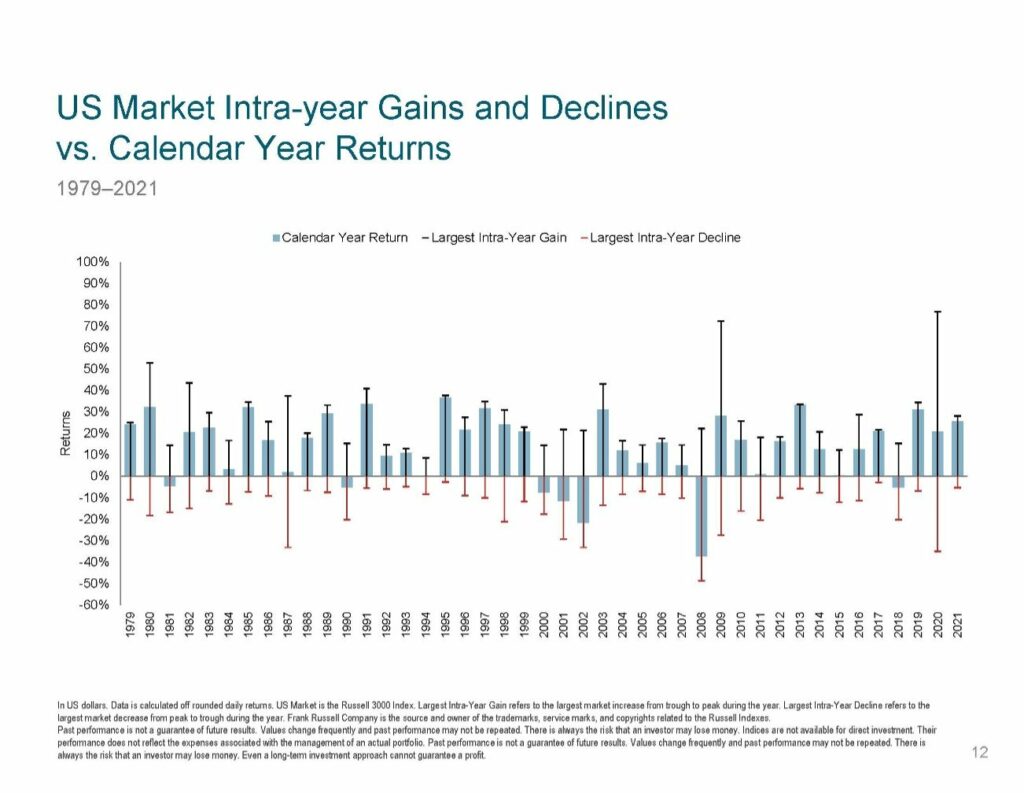

Large declines during the year are common. The chart below shows how far markets fell intra-year each of the last 43 years. As we live through another market price decline, it can be helpful to remember we have been through this before. Undoubtedly at each previous decline, there was the anxiety about what the future would look like.

Fig.2 Graph of US Market Intra-year Gains and Declines vs. Calendar Year Returns Source: Dimensional.

Recession Announcements vs US Stock Market Lows

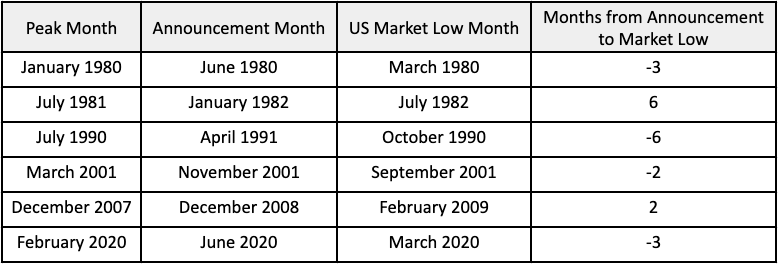

The bad news is recessions cannot be avoided. The good news is every previous recession has ended. Unfortunately, the timing of recessions does not necessarily coincide with the timing of stock market returns. Although the past is no guarantee of the future, it is interesting to see data from prior periods. The market low point might have passed before the recession has been officially announced.

Fig.3 Table of recession announcement vs US Stock market lows

Business cycle peak and recession announcement dates sourced from the National Bureau of Economic Research. US market represented by the Fama/French Total US Market Research Index. Source: Dimensional.

Short-term Moves vs Long-term Averages

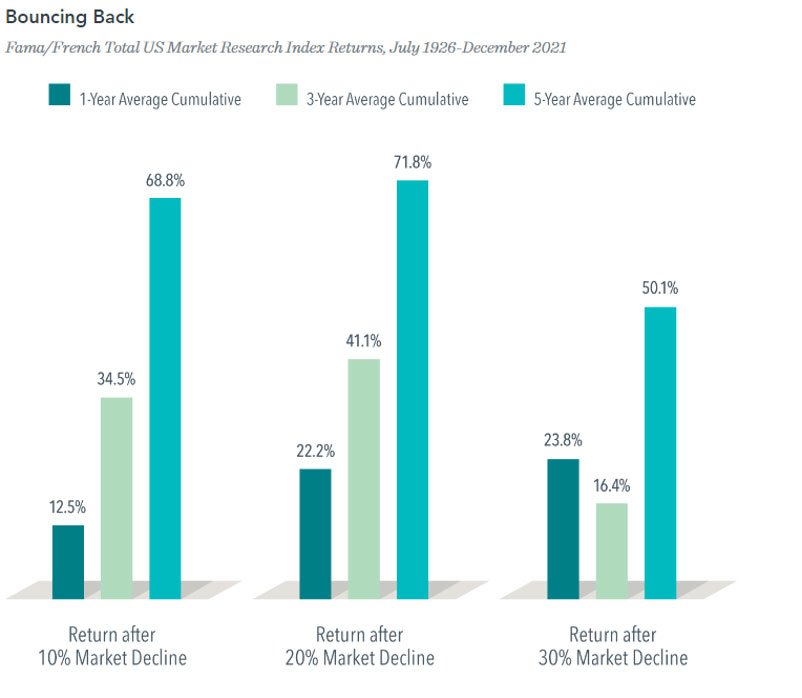

It is no secret that the biggest stock market gains happen around the biggest stock market losses. Simple math says that if long-term numbers are in the single digits, then double-digit market gains or losses are likely followed closely by other double-digit gains or losses. This does not mean it is a certainty or that it is easy to time. It just means investors should not be surprised by their proximity to each other.

To that point, below is an illustration of what average returns have been historically after 10%, 20%, and 30% declines.

Fig.4 Chart representing market return after a decline

Performance is no guarantee of future results.

Short-term performance results should be considered in connection with longer-term performance results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Data provided by Fama/French and available at mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html

Source: Dimensional.

Some “Do Something” Initiatives

Investors are forced to make decisions even with an uncertain future. From human behavior research, the initial reaction is to do something1. However, doing something is usually not the problem. The problem can be doing something abruptly based on emotional fear.

Given recessions are inevitable, having a plan beforehand is reasonable. A few “do somethings” might include:

- Rebalance portfolio to long-term targets. If equity allocation falls by a certain percentage faster than other investments, the investor will buy more equities to get asset allocation target back in line (i.e. buy at lower prices). The reverse is also true. If markets then rise quickly from market bottom, investors will sell equities (i.e. sell at higher prices).

- Tax loss harvest to offset gains or income. In taxable accounts, look for opportunities to reduce current year income without sacrificing long-term return potential.

Summer Driving

The Miler twins will be getting their license next month, so their dad has gotten additional experience with emotional restraint. Many of you have similar driving stories to tell. I do not have a hard time finding someone who can relate to these shared experiences. We get through them, but probably not without a few stories!

There are many parallels to driving and investing. The biggest similarities I have found are plan ahead, stay calm, and avoid over correcting. Below are phrases that can be overheard in our car:

- You do not have to speed to school if you leave early enough. (You don’t need to bet long-term success on one investment if given enough time).

- Things will happen on the road that you do not expect and losing control of your emotions will not help. (Market prices will be volatile and getting constantly anxious will not likely help).

- Avoid making sudden stops or swerves that cause the overcorrection to be worse than initial outcome. (Changing investment philosophies frequently because of fear might cause more damage than sticking with something).

We hope everyone is enjoying the official start of summer. Thanks for your continued trust and please do not hesitate to contact us with any questions.

1We wrote in our September 2019 newsletter about this human need for action using the elevator control button analogy.