Time is asymmetrical and flows in only one direction: forward. British astrophysicist, Arthur Eddington, developed this concept of “one-way” direction. He illustrated this concept by using an arrow. If by following the arrow you see more randomness, the arrow is pointed towards the future. If the arrow becomes less random, the arrow is pointed towards the past.

This one-way direction also says something else. As each moment passes, things change. Once these changes happen, they are never completely undone. Some physicists have spent their careers researching this concept. Coincidentally, we see this concept all around our everyday life. Houses are bought, fixed (and fixed again and again 😊) and eventually sold. Neighborhoods evolve. Communities and groups we are a part of change. Our families grow. Time continues onward.

Stephen Hawking had another way of thinking about the arrow of time. Very similar to Arthur’s concept, but stated a little differently. “The increase of disorder or entropy is what distinguishes the past from the future, giving a direction to time.”[1] As time passes, entropy increases.

Thus, we spend our lives fighting entropy. We meditate, sit, read, and write to fight mental entropy. We walk, run, and exercise to fight physiological entropy. We earn, save, and invest to fight financial entropy. There is no going around it. We just need to recognize and plan accordingly. Entropy is simply nature’s tax on our path through time

Supply Chain Disruption

“Our tools cannot ease supply constraints” – Jerome Powell, Federal Reserve Chairman (11/3/21)

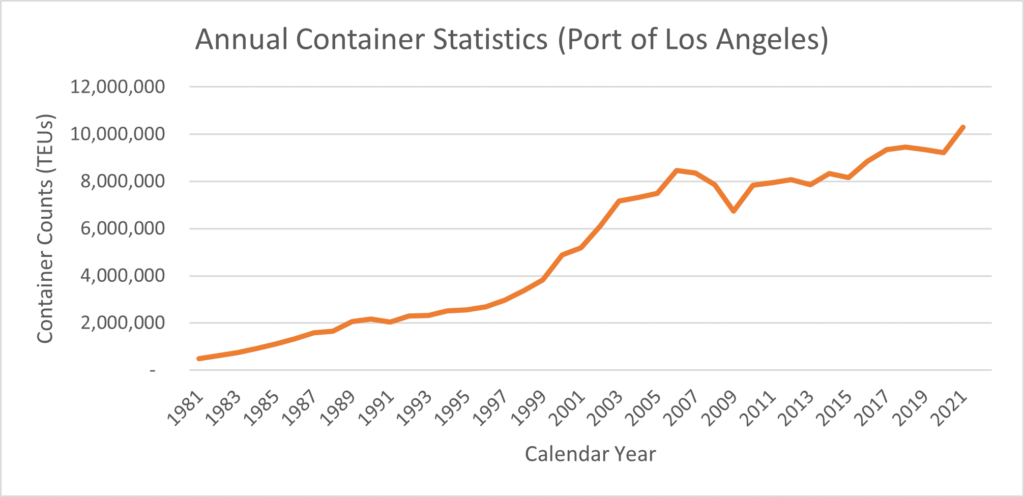

Another month has passed and with it continued supply problems. Given the large impact in our economy, we thought spending another month on the topic would be helpful. Much of the national discussion has centered on the Port of Los Angeles. For those looking to understand a little more about the port business, we recommend looking at the interactive map on the port’s website.[2] America’s Port® is the busiest seaport in the Western Hemisphere. To give some perspective on the containers being unloaded, here are the totals provided by the Port of Los Angeles[3]:

| 2018 | 2019 | 2020 | 2021(4) | |

| Total TEUs* | 9.5 million | 9.3 million | 9.2 million | 10.9 million |

Demand has not only been sustained during the pandemic but is now back on the growth path that existed before COVID. The top five categories of imports are also helpful in determining where supply problems are occurring: furniture, auto parts, apparel, electronics, and plastics. These containers are mostly arriving from Asia (>90%).

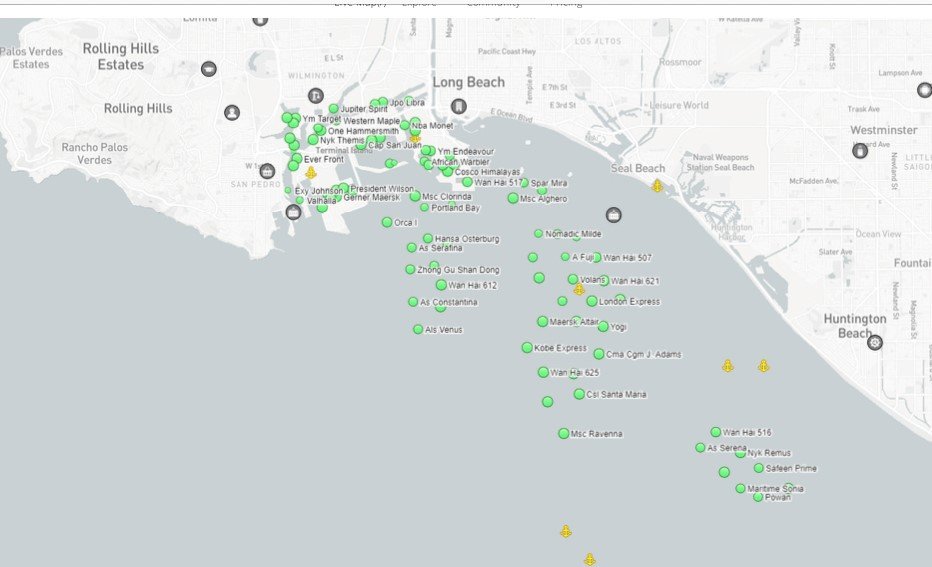

Total containers shipped continue to increase. Given COVID restrictions and disruptions to the labor market, the ports simply cannot keep up. Pictures and videos do a better job of explaining this. The images below depict LA and Shanghai ports on November 16th. The green dots are ships that are currently anchored.

To make the contrast even starker, take a look at this great visual comparing 2019 to 2021. Its an amazing difference: https://www.cnn.com/2021/10/23/business/20211023-california-ports-animation/index.html

This bottleneck will only continue to move through the system. What started happening at the ports is now also occurring with trucks and railroads. There is no quick solution, therefore it will take time to resolve the problem.

What Does it Mean?

This shipping disruption is like the arrow of time concept. The 2022 economy will not be the economy we knew before COVID-19. Time has disrupted that older version. “The Economist” reported in September that the price to ship from Shanghai to New York had risen from around $2,500 to closer to $15,000. This has big ramifications for the economy. Companies will either:

- Absorb costs (reduced profit),

- Pass along to consumer with price increases (inflation).

- Shutdown business because cost prohibitive (layoffs) or

- Move production back onshore (new jobs).

The future is uncertain but we would predict companies will do some combination of all four. Being broadly diversified across industries and being flexible in time, should help investors during this next messy phase.

The good news is the economy is always messy. This will be no different. You just don’t know exactly how the messiness plays out on a daily, weekly, or monthly basis. Incentives matter and people will continue to figure it out.

Firm Updates

New Team Member – Jodi Spears

We are excited to formally introduce Jodi Spears, our newest team member. You may have spoken with Jodi, as it is her friendly voice answering the phone each morning. If you have been in the office recently, you may have met Jodi as well. She is assisting with operational tasks while managing back-office activities and servicing client accounts. Interestingly, Jodi’s formal education and background are in social work! She lives in Menomonee Falls with her husband and three teenage daughters. Jodi and her family enjoy going to Brewer games and attending local theatre events. Please welcome Jodi to our MG team!

From your entire MG Financial Group team, we hope you and your families have a wonderful Thanksgiving holiday.

[1] Hawking, Stephen. (1988) A Brief History of Time: From the Big Bang to Black Holes

[2] https://www.portoflosangeles.org/about

[3] https://www.portoflosangeles.org/business/statistics/container-statistics

[4] We took 2021 YTD and projected similar 2020 October-December figures for Oct-Dec 2021