After the 2022 first-half investment performance, it is normal for investors to want to reevaluate their investment plan. Losses never feel good. It does not matter if the loss involves your favorite sports team, playing board games with your family/friends, or just seeing investment values decrease. However, we cannot say they are surprising. Losses are part of these events (is there a person reading this that has never lost in board games???? If so, let us know 😊). They cannot be avoided. That knowledge does not take the pain away, but it can help get through them.

Halftime Speech and Game Plan

Halftimes can be a great time to accomplish many important tasks. For sporting events fans, that means refreshments and bathroom breaks. For athletes, it means catching your breath and getting renewed energy. For coaches, it is revisiting the original game plan. What has worked well and what did not while comparing against original expectations. I knew this was going to be difficult if “this” happened. “This” happened. Should we adjust or stay the course? Why or why not? Building portfolios to accomplish certain investment strategies is no different.

The halftime speech for investment strategies looks something like this:

- Did each asset type perform consistently with the market and economic environment? Why or why not?

- Should assets be removed or existing assets be increased based on the answer to question1

- Should different assets be added to the portfolio? If yes, the reason should be based on either:

- Increasing expected return or

- Helping managing risk

Is Diversification Dead?

With each downturn, it is normal to question whether this time is different. The media along with complex product salespeople are quick to take advantage of these moments of doubt. They try to make a big splash to convince investors this time is different. The pitch is simple. Investment strategies that have worked for decades are no longer applicable, so you should try this unproven thing named _____. Ironically, the one thing that usually changes over the years is the salesperson, or the alternative strategy being pitched. Those seem to come and go based on what has recently done well.

Warren Buffett is no stranger to this threat. Every decade a new group of investors tries to mock his simple investment style and claim his approach no longer works. There will always be times when others outperform him and try to attack his style. However, what we have seen is those investors usually do not stick around very long. Over time, their “this time is different” investment style fades into the background never to be heard from again.

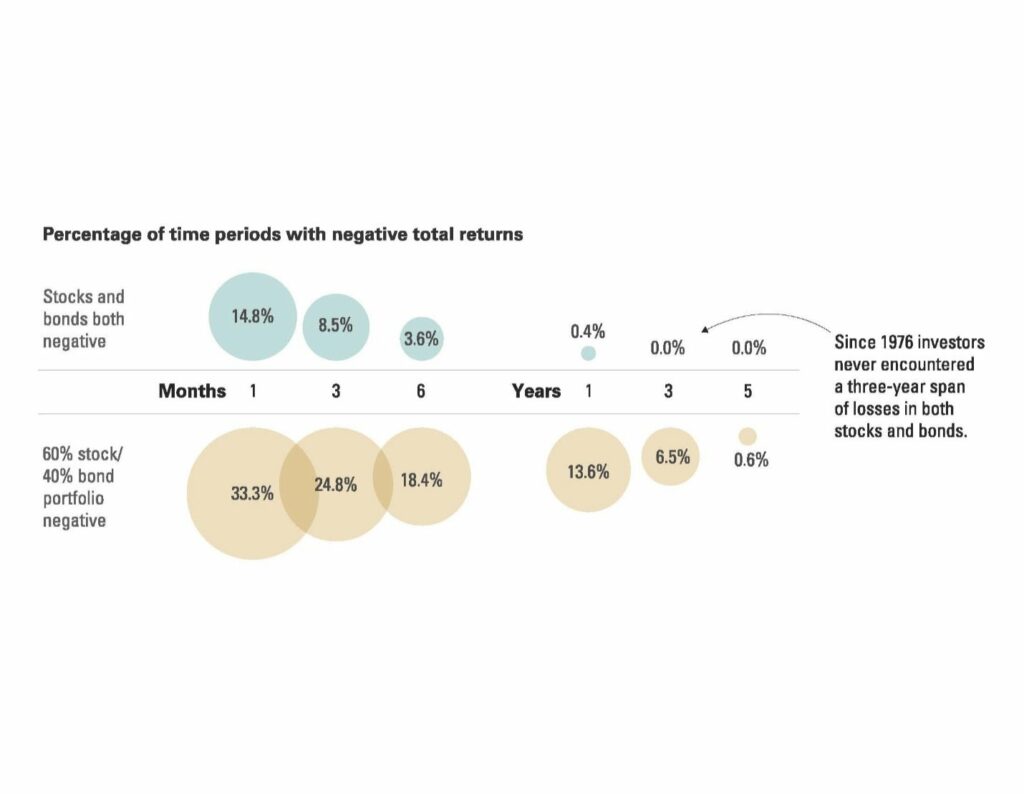

Stock-bond diversification strategies receive these same attacks. However, much like Warren Buffett, these simple but not easy portfolios continue to roll on like an army of steamrollers. Sure, they have their drawdowns in the short-term. The good news is investors we help have a longer-term view of their investments. The short-term drawdown is part of the cost to achieve long-term success. Here is a helpful chart illustrating 60% stock/ 40% bond portfolios over the short and longer time periods.

Fig.1 Source Vanguard Data reflect rolling period total returns for the periods shown and are based on underlying monthly total returns for the period from February 1976 through April 2022. The S&P 500 Index and the Bloomberg US Aggregate Bond Index were used as proxies for stocks and bonds. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

As we mentioned in our newsletter in February 2021, high-flying return years should be approached with caution. What goes up quickly, based on speculation alone, can make the reverse trip down just as fast. Time will tell whether these “alternative” investments will ever succeed. However, we do know that last year’s sellers of shiny objects with promises of spectacular gains, might not be terribly different from this year’s sellers of doom and gloom forever products. The future is usually never as easy or bad as what we think in the moment.

Enjoy Summer

As summer continues to roll on in Milwaukee with outdoor music, fests, and fairs, we hope everyone is getting able to enjoy it with family and friends. Thank you for your continued trust and please do not hesitate to reach out to us with any questions.