It is no secret that interest rates are rising. It is also no secret that these higher rates are influencing borrowing and investing activity. However, not all rates move in unison. It is helpful to understand what rates have moved and what might lie ahead. If you have any specific questions about your personal situation, please do not hesitate to contact us.

Real Estate – Interest Rates

Not surprisingly, the quickest effect is being felt by borrowers. Here is an updated look at the 30-yr mortgage rates. With 30-yr interest rates moving from 3% to 5.5%, the monthly payment (principal/interest) cost for a $300,000 30-yr home loan has increased by almost $450 per month! Just as lower interest rates helped push home values upwards (read our Why Are Interest Rates So Low article), higher interest rates may cause values to decline. If these new higher rates are here to stay, the housing market will need to shift.

Fig.1 30 year Fixed Rate Mortgage Rates

Rising rates is a function of money moving through the bank “plumbing” system. A quick example of how this works might be helpful. Bank A receives deposits from their savings customers and then turns around and lends those deposits to borrowing customers. To the extent that banks loan more money than they receive in deposits on a given day, they can borrow from the Federal Reserve Banks1.

The Federal Reserve Bank charges banks a rate for those overnight loans. If the Fed raises the overnight loan rate, then banks will want to pass that charge along to their borrowers. They are not in the business of losing money! This is in fact what you have seen.

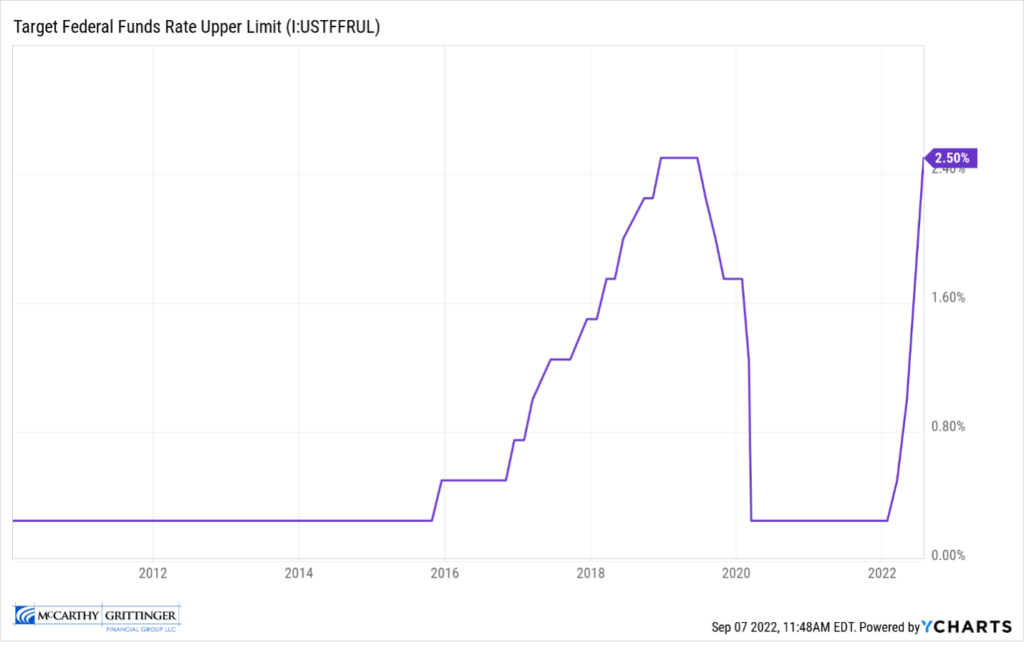

The Fed has risen the federal funds rate from 0.25% to 2.50% (see Figure 2). This would explain why mortgage rates have risen by about 2.5% this year. The costs for banks to borrow from the Fed and for customers to borrow from the banks have risen by about the same this year.

Fig.2 Target Federal Funds Rate Upper Limit

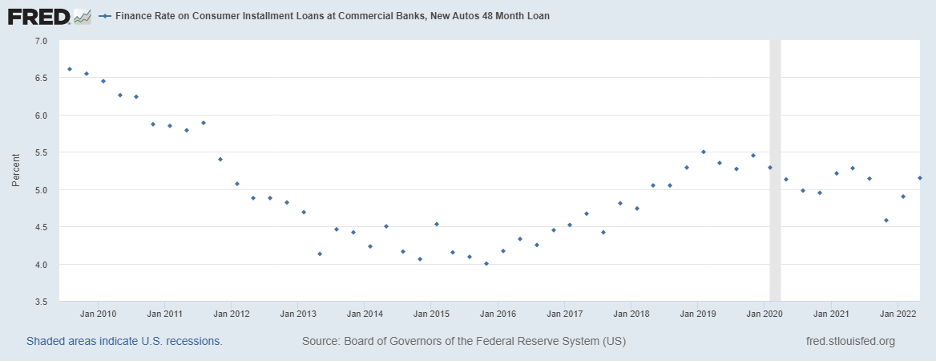

Vehicles – Interest Rates

New car loan rates are rising, but not as swiftly. We believe there are logical reasons for this. First, these are shorter-term loans. These might be 5-year loans as opposed to 30-year loans. Interest plays a much smaller role in the overall monthly payment.

For instance, a change of 3% to 5.5% on a 5-year $30,000 car loan, increases the monthly payment by about $40 per month. Not insignificant but less of a monthly burden than housing payments.

In addition, vehicles have other issues besides interest rates. Needless to say, these other issues are causing more of a current problem than rates. For more on vehicle supply and demand see our Vehicle Sales: Supply or Demand Issue blog article.

Fig.3 Vehicle Finance Rates on 48-Month Loan

Checking Account – Interest Rates

We all probably get monthly checking account statements. We have also seen the interest rate earned on those checking accounts. The argument could be made that the interest earned on these accounts over the last decade has been indistinguishable from zero.

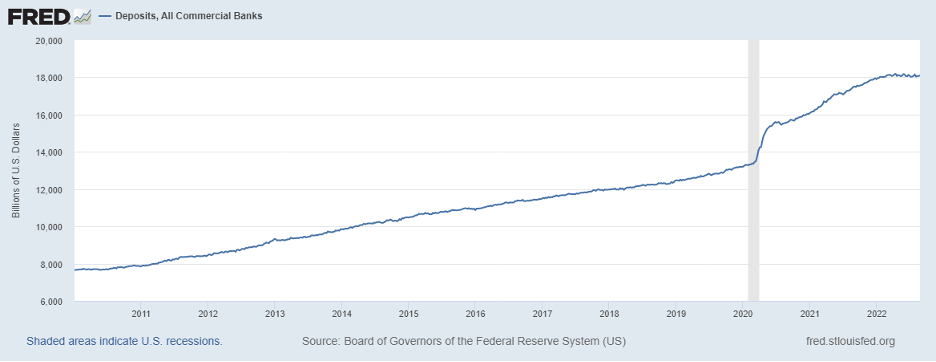

The commercial banks currently have significant deposits on their books. From Figure 4 below, you can see that deposits have increased from $14B in 2020 to almost $18B today.

Fig.4 Deposits at All Commercial Banks

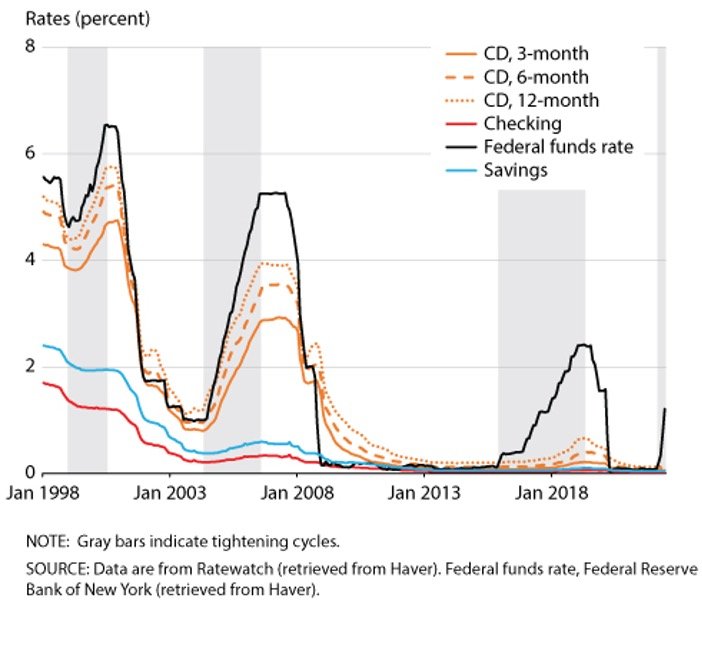

Because banks are not in a rush to acquire more deposits, they have been slower to raise deposit rates. As you can see from Figure 5 below, not much has changed recently in these accounts. The Federal Bank of St. Louis published a paper recently highlighting the slow-moving deposit rates in relation to the federal funds rate. Checking and savings rates show almost no response to the increase in the federal funds rate dating back to the 2007-2009 Financial Crisis.

Fig.5 Deposit Interest Rates by Product, January 1998 – June 2022

Money Market Funds – Interest Rates

Another possible alternative for short-term emergency cash positions are money market mutual funds. Money market mutual funds work differently than checking and savings accounts referenced in figure 5 above.

They are not insured against loss by the FDIC. In addition, they need to be bought and sold with brokerage accounts. Typically, fund managers try to keep the price per share as close to $1 per share as possible. These money market funds are typically invested in a basket of very short-term, highly rated credit securities.

Some money market funds can directly transact with the Federal Reserve Bank of New York. This ability allows them access to the effective federal funds rate that the Federal Reserve targets to control rate levels. This is important because qualified money market funds can earn the increasing rate on overnight investments (currently the range is 2.25-2.50%). Given current projections, many are expecting this rate will increase to 3.00-3.25% in September and maybe 3.75-4.00% by the end of the year.

As investors should expect, there are possible reasons for and against using this investment product. Factors to possibly consider are time horizon and liquidity needs for funds. In addition, practical reasons such as ability and desire to create another account should be considered. However, it is an example where we see interest rates for short-term investments rising faster than the usual checking and savings accounts.

Takeaways

September is historically associated with back-to-school activities and the official close to another summer. In 2022, it also might mean more interest rate hikes. As we continue to live through this short-term volatility, we think this note from Seth Klarman about investing sums up our current thinking.

“To maintain a truly long-term view, investors must be willing to experience significant short-term losses; without the possibility of near-term pain, there can be no long-term gain. The ability to remain an investor (and not become a day-trader or a bystander) confers an almost unprecedented advantage in this environment. The investor’s problem is that this perspective will seem a curse rather than a blessing until the selloff ends and some semblance of stability is restored.”

Thank you for your continued trust and please do not hesitate to contact us with any questions.

1 Special thanks to my banker friend Greg Block of First Business Bank for helping me with my bank education. He reminds me often that no matter how complicated it gets, just remember that every night bank assets have to equal liabilities plus equity. Banks do that with overnight loans.