This is the question that is on everyone’s mind. For savers and borrowers alike, interest rates are a key topic of discussion and a central ingredient of the economy. Should borrowers try and lock-in the loan at today’s rates? Should investors buy that bond at today’s rate? Before we get into more detail about interest rates, we think it is helpful to quickly review a few bigger items to keep in mind.

Starting Line Discussions

We discuss your investment horizon quite frequently in our communications. The purpose is to establish base case scenarios for expectations related to cash flow and to investment returns. We believe that in the short-term market returns are bumpy. They can get too high and too low. Over time these should average out. Remembering that can provide some relief as we live through the ups and downs.

Interest rates are no different. If you buy a 10-yr bond with a 3% interest rate, you should expect a 3% return over those 10 years. However, the calculated returns each year will look different. Some years will be higher and some will be lower. When all is said and done, if you held the bond (or bond fund) for that entire period, the return should be around 3%.

The same example can be said for 1-year bonds, 2-year bonds, 5-year bonds, etc. The biggest two variables in the calculation are starting rate and time held. Hence, time horizons matter for both the investment choice and the investor cash flow needs. Spending equal time knowing both is what delivers successful long-term investment stories. Finally, Jason Zweig (writes Intelligent Investor column for WSJ) had this to say recently about bonds “remember why you own them. Bonds aren’t meant to make you rich; they keep you from becoming poor while paying you some income along the way.” A helpful big picture reminder too.

Law of Large Numbers

We have seen some significant increases in asset values this past decade. Most investors have investment balances that they have never seen before. We have learned that investors can have difficulty with handling the ups and downs if they begin to focus only on the dollar amounts. Simply a fact of even small percentages on big number, is still a big number. Not necessarily a reason to panic.

Let’s take an example. Investor A, B, and C all invested in the same investment portfolio.

- Investor A: $1,000

- Investor B: $100,000

- Investor C: $1,000,000

The long-term expected average return is 8%. However, in year 1 the portfolios fall -10%. The portfolio reductions are:

- Investor A: ($100)

- Investor B: ($10,000)

- Investor C: ($100,000)

Investor A is just starting out. Investor B has been doing it for some moderate amount of time. Investor C has been doing this consistently for long time. If we are fortunate to live long lives, most people will experience being Investor A, B, and C. However, we carry our prior year experiences with us. This means that we will probably have our biggest dollar gains and losses in the latter part of our lives.

We have learned through experiences that this can be unsettling for investors. However, we are here to remind investors that this is normal. It may have less to do with the allocation and more to do with the law of large numbers. Small percentages on large numbers is still a big number. It works in both directions and that is why Albert Einsten proclaimed compound interest to be the eighth wonder of the world. Over long periods of time, it is what partly turns Investor A into Investor C.

Recent Events

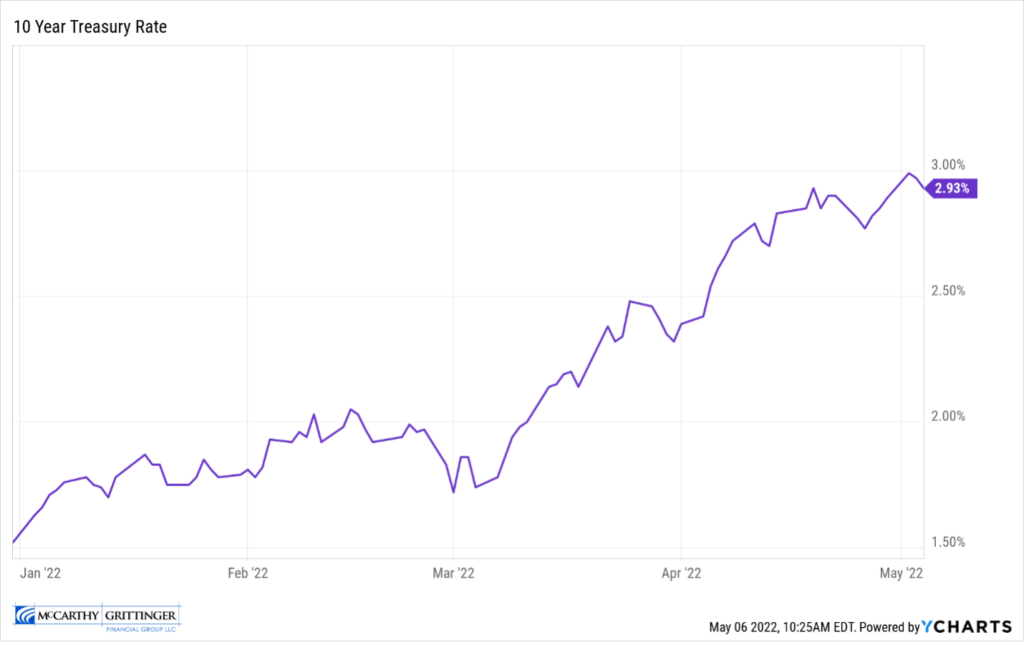

Interest rates have risen around the world from the pandemic lows. The chart below shows the recent rise in the US. The US Treasury 10-year rate has now risen above the pre-pandemic rate.

Fig.1 Graph of 10 Year Treasury Rate – January 2022 through May 2022

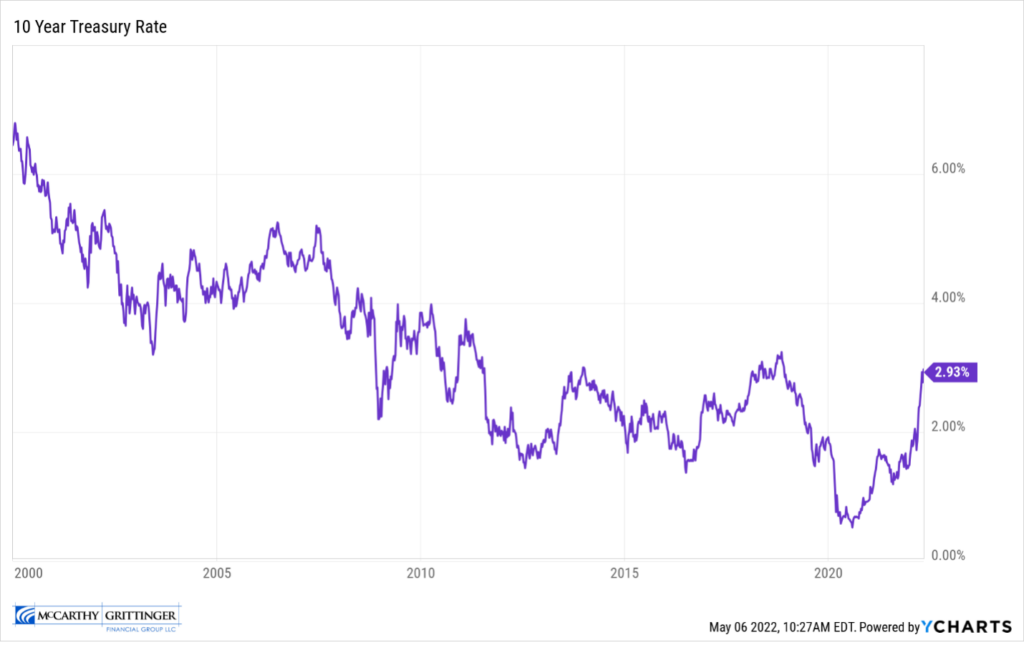

Although this looks like a large jump in rates, if you zoom out to the last 20 years, it tells a different story. This recent rise is still well below where interest rates were in the 2000’s.

Fig.2 Graph of 10 Year Treasury Rate – 2000 through 2022

Mortgage Rate Effects

There is also the opposite side of the coin with regards to interest rates. For every investor, there is a borrower. As individuals, we most likely see that borrowing rate on mortgages. Below is a chart showing 30-year mortgage rates since 2000. These past few months the mortgage rates have surged higher. From the chart, you can see that rates have not been this high since 2009. This jump of 2% in mortgage rates if it holds will certainly influence home prices. For example, the monthly payment difference for a $300,000 30-yr mortgage at 5% versus 3% is almost $350/month. Not an insubstantial amount. This will continue to be an important figure for real estate.

Fig.3 Graph of 10 Year Treasury Rate vs 30 Year Mortgage Rate

Interest rates are an important part of our economy. The Federal Reserve is given control of the short-term rates for a reason. When prices rise quicker than intended, they are tasked with raising rates. That is where we sit today. Prices have risen and have continued to rise, so the Federal Reserve is forced to act. People can always argue over the timing and the amount of the increases, but rising rates will ultimately have an impact.

Although rates are rising, there are probably limits to how high they can go. The price and mortgage example highlights this issue. If rates rise too fast, current market prices will fall substantially and homeowners will not be able to afford the monthly payments. Large quick price movements can cause other ripple effects. The Federal Reserve is aware of that too. Rising prices have a way of fixing rising prices.

Moving Forward

Similar to the stock market, no one knows exactly the future direction of interest rates. However, investors and borrowers need to make decisions with imperfect information. Knowing your time horizon helps with this uncertainty. For instance, large short-term needs should be handled differently than small long- term needs. Higher interest rates on bonds should eventually lead to higher investment returns. Investors just need to match that time horizon. It also takes patience and a steady hand not to overact to issues that do not change your current cash flow plan.

As a reminder for those with additional cash savings that do not need the cash for short-term needs, you can revisit the US Treasury Series I Savings Bonds we wrote about last December. Read the post What is going on with inflation? The current rate is now 9.62%.

MG Team Updates

We have two exciting announcements!

Matt Miler has been named Managing Partner

As you may have seen with our recent annual filing of our Form ADV with the SEC, Matt Miler has taken on duties as Managing Partner of McCarthy Grittinger Financial Group. We are excited to have Matt guide our firm forward in our mission to best service our valued clients in key areas of their personal financial lives. He has also assumed the day-to-day management of the firm. Matt brings 20 years of valuable experience in our industry, and we are thrilled to have him take on this leadership position.

Scott Grittinger steps down as Managing Partner and will continue in his role as a Senior Financial Advisor as well as majority owner and Partner. We believe this is the logical next step in ensuring the ultimate long-term goal of continuing to serve our clients well into the future.

New Team Member – Diane Bueche

We are excited to formally introduce Diane Bueche, our newest team member. You may have spoken with Diane or seen her in a recent office visit. Diane is originally from Wisconsin, grew up in Brookfield area, and then spent years in the banking industry before being a stay at-home mom to raise her three children. She currently lives in Whitefish Bay and loves living near the lake and enjoying all it has to offer. In her free time she loves to travel, listen to live music and volunteer her time in both Adult and Youth Ministry programs at St. Monica’s and St. Eugene’s Parish. Please welcome Diane to our MG team!

As we try to escape the grasp of the Midwest winters, we hope you and your families can soon enjoy warmer spring days that are hopefully just around the corner!